Executive Summary

Coffee Shop Owners is the first in a series of reports focusing on industries with a significant small business presence. Key economic information reported readily in the media such as gross domestic product (GDP), consumer price index (CPI), retail sales, interest rates, and labour market statistics are largely irrelevant to the average small business owner and are not industry-specific. These macro-economic results are largely dependent on macro events such as the price of iron ore which obviously has no relevance to the trading conditions for a cafe owner, plumber, electrician, or gym owner.

Considering small business' (defined as an entity that employs less than 20 employees) contribution to the Australian economy, we wanted to assist in creating information that would be relevant to small business owners.

Small Business - Contribution to the Australian Economy

- 2.1 million actively trading businesses (97% are small businesses)

- Account for 35% of the value generated in the economy

- Contribute over a fifth of the nations GDB

- Employ over 5 million people (44% of all people employed in the private sector)

Considering there are over 20,000 cafes employing more than 127,000 workers and that they literally fuel the country through providing that essential cup of coffee or bacon and egg roll, it seemed like the perfect industry to start with.

At the time of sending out the initial survey to selected cafes around Australia in 2018, the country and the world were in a relatively good place. Fast forward to 2021 when those same cafes were contacted to check in on changes in sentiment and the world was not in the same state. COVID-19 arrived in early 2020 and depending on the state you were operating within, had a moderate to severe impact on the industry.

To think a global event would result in the forced closure of businesses and then staged re-openings would of been hard to fathom before 2020. Thankfully the Australian Government's stimulus measures including the $100bn JobKeeper program has allowed many businesses to move from being on life support back into operation. However, further lockdowns could be the straw that finally breaks the camels back for owners who have been through significant financial, business, and mental stress as a result of having their livelihoods put on hold or at significant risk.

At the time of writing this report, Australian vaccination levels have crept up slowly over 2% while most developed countries are approaching 50% and are therefore able to lift restrictions and start returning to a sense of normality.

While the demand exists, the increasing number of cafes in inner-city locations in close proximity to Melbourne and Sydney CBD's has resulted in volatile trading conditions with approximately 20% of operators contacted in 2018 no longer in business in 2021. IBISWorld statistics from the ABS indicate an average exit rate from the industry of over 18% per year over the last 5 years. However, with an average industry entry rate of over 20% per year, the number of net new establishments continues to grow with the exception of 2020/2021 which for the first time recorded a net loss of establishments.

Ignoring financials and taking the most simplistic view, the success of your cafe ultimately comes down to how good your coffee is. If there are multiple cafes in close proximity then in our experience, the customer may forgive consistency and pricing on food but will not negotiate on finding the best cup of coffee. If you can predict one thing this is it: customer loyalty starts with quality coffee. Whether this is sourcing the right coffee bean, milk alternatives (the list is never-ending), hipster barista or sparkling new colour coordinated La Marzocco machine, these efforts are critical in winning over your customers.

However the $4 coffee customer expects more - they want the experience. For them, it's a luxury habit that must include a warm greeting ("the usual?") and the fit-out and atmosphere of the cafe must provide the customer with an experience that lets them escape their busy day, whether it be a worker on a quick break or a stay-at-home parent looking for some me time.

The two costs to keep an eye on

Now to the important stuff, the numbers! If you can effectively control just two costs you will be successful. Labour and food costs account for up to 70% of the sales most cafes achieve. Labour costs are generally 25% to 35% of sales while food costs are generally 25% to 35% also, and where your cafe should sit in this range depends on your menu offering. While the takings and upside of offering a more expansive menu may seem attractive, the risks of failure are considerably higher. In fact, this trend has seen many new cafes focus on coffee with the provision of only pastries and pre-made goods. This has allowed good operators to get labour and food costs down considerably. IBISWorld estimates cafe revenue to be approximately 64% coffee, 16% other beverages and only 20% from food.

Market Trends

Strong market trends noticed in the industry prior to COVID-19, was the increasing use of cafes as a place of work and meetings. Therefore for new entrants, this should be a consideration when fitting out your cafe, whether it be considering the size of the table (nothing worse than a wonky small table where the coffee does not fit next to the laptop) or providing power access for laptops and phones. These measures can build customer loyalty and establish your customers daily habit of visiting your cafe to check emails or catch up on some work while enjoying a coffee.

Another growing trend noticed is the growth in mid sized cafes roasting their own beans. This provides a clear point of differentiation, reduces your cost of beans, allows you to sell your beans both as a retail and wholesale product and adds to the overall ambience of your cafe. There is nothing better to draw in customers then the smell of freshly roasted beans. Further there have been a number of recent lucrative acquisitions of local coffee roasters including, Asahi Beverages aquisition of Allpress Espresso and JDE Peet's acquisition of Campos Coffee.

The last trend to be mentioned is where at TR Consulting we have worked with a number of operators in building a business model that involves the set up or acquisition of a poor performing cafe with a 2 - 3 year view to then sell. This process can then be refined and repeated. When executed well there is more financial reward in this approach then holding on to a cafe for the long term.

The major problem with maintaining required margins is that the best tool to use in business is to increase your margins by increasing your pricing. However, in such a competitive industry with the major product being a $4 to $4.50 coffee, the consumer expectation does not match the financial needs of the business. An example is that the cafes investigated had increased their coffee price by 3.9% over the three-year period, however, the average cost of wages had increased by 6.7%. But are customers ready to pay $5 for their daily cup of coffee? Unfortunately, most customers aren't business owners and do not appreciate what goes into a humble cup of coffee, not least what is a fair and reasonable price considering what is required to cover overheads (Wages, Food Costs, Rent, Utilities etc).

The overall sentiment of operators contacted had deteriorated, but considering the circumstances, less so than most would expect.

The key findings in the respondents surveyed included:

- 77% (2018) / 70% (2021) only operated one single operation

- 17% (2018) / 23% (2021) had been in business for over 11 years

- 46% (2018) / 37% (2021) reported annual sales of greater then $1 million annually

- Social Media was consistently viewed as the most important marketing tool for the business

- In 2018 finding and keeping a good chef was the most difficult staff member to retain

- In 2021 finding and keeping a good barista was as difficult as the chef

- 35% (2018) / 17% (2021) responded that their business was better off then the same time last year

The majority of respondents in 2021 highlighted that the business challenges presented by COVID-19 had a significant and detrimental impact on their mental health. While the short term future still holds uncertainty and difficulties for business owners, there is hope that as the shackles of lockdowns become a distant memory, the legacy impact may be the greater value customers now put on being able to dine out or grab their daily coffee without taking it for granted.

As Albert Einstein once said "in the midst of every crisis, lies great opportunity". For the savvy operator there have been opportunities to purchase established cafes where owners are looking to exit long term lease commitments compared to pre-COVID where these same cafes would be sold for > 3 times multiples of annual profit. These same operators are likely to build these operations back up and flip them back into the market in a few years when the uncertainties of COVID-19 have cleared.

As always our advice to clients is to have a detailed 3 - 5 year plan that addresses these risks and opportunities and most importantly sets realistic goals and expectations. It is a challenging industry that operates on thin margins, however the demand for cafes will always exist.

Industry (Market) Review

The industry comprises cafes and coffee shops that serve food and beverages to customers on-premises. This category excludes takeaway food services, restaurant, and catering services, theatre restaurants, and establishments that primarily sell alcohol.

Business Location

New South Wales, Victoria, and Queensland account for over four-fifths of industry establishments and over 77% of the population. New South Wales and Victoria have a larger share of cafes and coffee shops than their population base would indicate. This is largely due to higher average incomes in these states and greater demand for cafe meals and beverages. Furthermore, Melbourne’s entrenched coffee culture has resulted in many new cafes and coffee shops opening in inner-city areas. Less densely populated states and territories such as Tasmania, The Australian Capital Territory, and The Northern Territory account for the smaller share of the industry, representing a combined 4.8% of all establishments.

Key External Drivers

Rising demand for restaurants can put downward pressure on demand for coffee shops and cafes as they are direct substitutes. The demand from restaurants is expected to increase in 2020-21. The consumer sentiment index measures how people feel about their current financial situation in regards to the economy. If positive, consumers are more willing to spend their disposable income compared to when this index is negative. Consumer sentiment is expected to increase but remain negative in 2020-21.

Coffee is observed as an affordable luxury, therefore with an expected decline in disposable income, this could pose a threat to industry revenue.

Cafes must compete with entertainment activities and other leisure and recreational pursuits for a proportion of the household disposable income. Expenditure on recreation and culture is expected to rise in 2020-21, providing an opportunity for the industry to grow. Value for money, convenience, and time available for leisure, all affect demand.

Demand Determinants

With more consumers living on the go, cafes have become popular locations for business meetings, discussions, and quick catch-ups. Australia's vibrant coffee culture is another drive of industry demand. Success depends on understanding the nation's corporate culture as size/market share does not necessarily determine success. Several COVID-19 factors have constrained the industry demand throughout 2020-21. Factors including state lockdowns, takeaway only, social distancing and venue capacity limits have reduced the volume of customer demand.

Competitive Landscape

The Cafe and Coffee Shop Industry has a low level of market share concentration with no player accounting for more than 5% of revenue in 2020-21. The industry is highly fragmented and dominated by small, individual, and unique businesses. Consumers often choose independent cafes & coffee shops over chain stores for greater choice, tailored coffee, unique product offerings and the personal touch.

There are larger competitors such as Retail Food Group (who owns Gloria Jeans, Donut King and Crust Pizza), and Starbucks within the industry, however, they have limited market power and cannot solely influence the industry in terms of product and price.

"In 2018-19 Retail Food Group closed 173 domestic outlets including some Gloria Jeans due to rising competition and high rent costs." - IBIS World 2020

Retail Food Group - Major Player Timeline

In 2017, Retail Food Group (RFG) Limited had acquired 5.1% of the market share making it the largest player in the industry. Traditionally, however, the coffee market had not been favourable to larger brands.

Between 2011 - 2017, RFG industry segment revenue had grown strongly and was expected to grow by an annualized 13% over the next five years, strongly outperforming the wider community. However, in 2021, Retail Food Group had a decreased market share falling to 3%, had closed a total of 173 domestic outlets in 2019, and closed a further 100 domestic stores during the COVID-19 lockdown between 2020-21.

In 2019, The ACCC (The Australian Competition and Consumer Commission) investigated RFG for alleged engagement in unconscionable and misleading conduction dealing with franchising, breaching the Australian Consumer Law between 2015 - 2019. In December 2020, The ACCC commenced proceedings in The Federal Court against Retail Food Group Limited for allegedly withholding profit and loss statements from incoming franchisees who were undergoing the process of purchasing the loss-making corporate store. Along with misleading and withholding financial information, The ACCC is also investigating RFG for breaching franchising code, as franchisees were to pay marketing funds, which RFG is alleged didn't spend on marketing but included personnel costs for executives.

- ASX (Australian Securities Exchange) closed with RFG on the 1st January 2017 share price of $6.44.

- The April 2021 ASX share price closed at $0.075

- Resulting in a 195% decrease and a decline of $6.365 across 4 years of operators

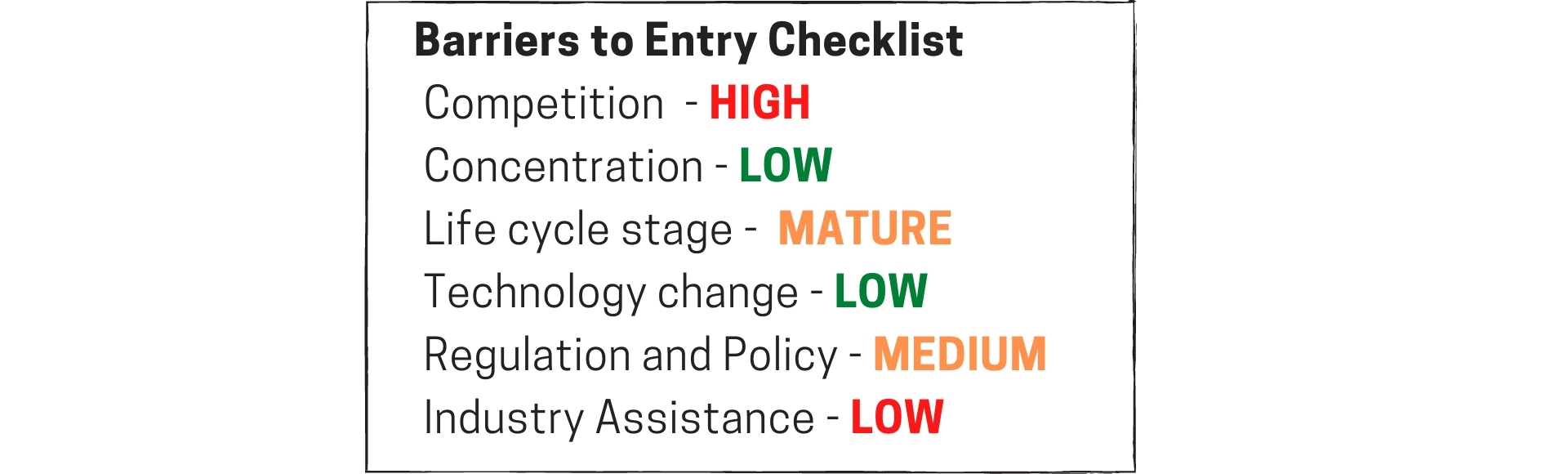

Barriers to Entry

Barriers to entry in the Cafe and Coffee Shops Industry are currently low and steady indicated by its numerous entries and exits. New operators can enter relatively easily as owners can minimise their establishment costs by leasing premise equipment, furniture, and fittings. Franchising arrangements often allow easy entry into the industry. No formal qualifications are required, although experienced and trained staff in hospitality are beneficial.

Key Success Factors

IBIS identifies 250 key success factors for all businesses and has outlined the four most important factors relating to the Cafe and Coffee Shop Industry:

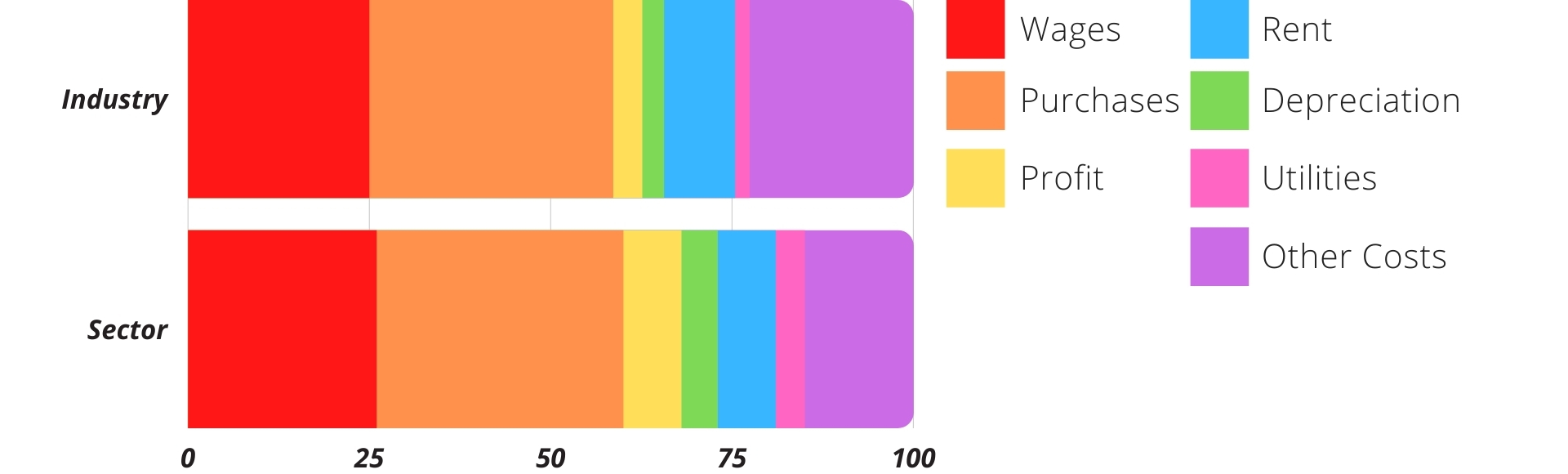

Cost Structure Benchmarks

Industry profit margins have declined as a share of industry profit over the past five years.

Labour and food costs account for up to 6o% of total expenses, and an owner's ability to control these costs effectively will be the most critical factor in the viability and profitability of their business.

Generally, rent will be less than 10% of the total turnover. The other costs are smaller and the operator has less control over them, such as utilities.

Cafe Sentiment Industry Report

In 2018, TR Consulting approached 400 coffee retailers operating within the CBD and surrounding suburbs of Melbourne, Sydney, Adelaide, Perth, and Tasmania to acquire a statistical sample size to draw resourceful information from the data gathered. In 2021, the process was repeated with additional questions regarding the COVID-19 pandemic. Along with the original 400 cafes, a further 300 cafes were sourced to obtain a larger data sample to statistically present the information provided. The information gathered in this section specifically measures the degree of optimism that café retailers feel about the future of their business.

The findings are shown below and provide guidance to existing and new operators in determining menu pricing:

2021 Average Coffee Price

- Melbourne (CBD and surrounding area): $4.07 (+3.3%)

- Sydney (CBD and surrounding area): $4.01 (+3.08%)

- Adelaide (CBD and surrounding area): $3.97 (+5%)

- Perth (CBD and surrounding area): $3.96 (+0.76%)

- Tasmania (CBD and surrounding area): $4.19 (+6.62%)

2018 Average Coffee Price

- Melbourne (CBD and surrounding area): $3.94

- Sydney (CBD and surrounding area): $3.89

- Adelaide (CBD and surrounding area): $3.78

- Perth (CBD and surrounding area): $3.93

- Tasmania (CBD and surrounding area): $3.93

Average price increase over the period of a standard coffee rose 3.86% versus wage costs which have increased by 6.7% over the comparative period.

Over the three-year period investigated, 19% of cafes operating in Melbourne and Sydney ceased trading.

- Melbourne (CBD and surrounding area): 18.7%

- Sydney (CBD and surrounding area): 19.2%

- Adelaide (CBD and surrounding area): 6%

- Perth (CBD and surrounding area): 8%

- Tasmania (CBD and surrounding area): 7%

This section has been divided into two parts:

- Analytical insights across two data pools (2018 and 2021) and

- A summary, to highlight several key findings which hopefully assist existing or imminent cafe owners in making future decisions.

Information readily available is often misleading as it is generic in nature and can be materially different from one industry to another. As such, this report provides relevant, timely and real responses from existing small business owners operating a cafe.

The analytical insights, results, current trends, opinions, and concerns provide a reliable source of information to existing and new entrants to this challenging industry where operators need to survive on paper-thin margins.

Analytical Insights

Business Overview

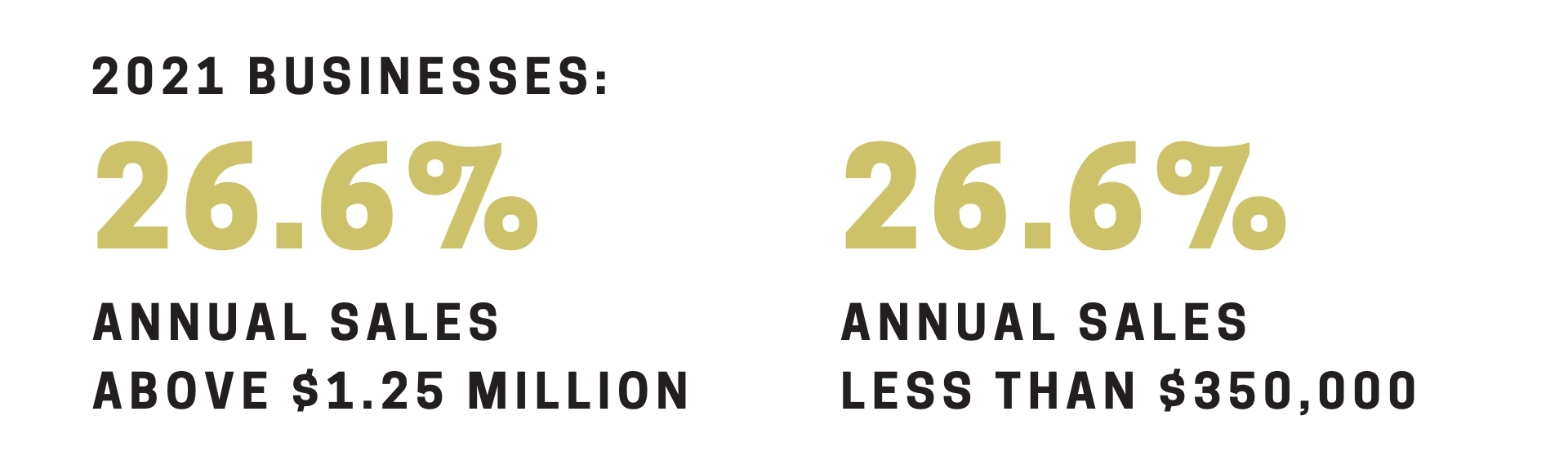

Of the 27% of 2021 cafe owners that indicated their business had annual sales under $350,000, half had only been operating for under 2 years. A common mistake found across new entrants is the time expected to ramp up a new cafe to forecast takings. For example, a small cafe that will stabalise takings at $1,000 per day ($30,000 per month) may take up to 6 - 9 months to reach this point. The problem new entrants can find is they therefore do not have sufficient working capital to reach this point or experience increase business stress until takings eventually stabilise.

An equal amount of cafe owners (27% in 2021) indicated their annual sales to be greater than $1.25 million. From this percentage of cafe owners, 60% had been operating for 6 - 10 years within the industry and the remaining 40% had operated for over 11 years. 80% of respondents indicated that they were looking to buy or acquire more cafes in the next 3 years. 60% of cafe operators with annual sales greater than $1.25 million, agreed that social media was the most important marketing tool used to promote their business, with an additional 30% ranking it second most important behind Google Pay Per Click advertising.

A common opinion from both types of cafe owners (with annual sales under $350,00 and annual sales over $1.25 million) regarding the most useful piece of advice for new entrants to the industry was “do not expect success overnight”. However, for cafe owners who achieved sales of $1.25 million annually, 75% of them suggested to new entrants wanting to join the Cafe and Coffee Shop Industry to “reconsider it”. This pessimistic view highlights the challenges the industry faces even by those owners who had built up a sizeable operation.

The below graph shows the sales achieved by the cafe respondents across both 2018 and 2021.

Major Markets

The Cafe and Coffee Shop consumers can be broken down into three age groups

- People aged 15 - 34

- People aged 35 - 54 and

- People aged 55 and above

As discretionary income is a key external driver, the share of the revenue for each major market (age group) does fluctuate depending on consumer lifestyle trends and the ability to access discretionary income.

People aged 15 to 34

In 2021, this group represented 35% of the market (second largest market group) and is generally made up of school/university students and people at the beginning of their professional careers. Discretionary income is generally lower compared to other market groups however, these consumers view their coffee as an affordable and essential part of their daily routine. People aged 15 to 34 are also more likely to view cafes as a social hub, therefore increasing the probability of purchasing additional products such as food. This market group, however, demands high-quality food and coffee, subsequently generating competitive threats to convenient stores and cheaper alternatives.

People aged 34 to 54

In 2021, this group represented the largest proportion of the industry at 37.3% and is mostly made up of steady income earners. This age group is often time poor and on the run from home life to work life, therefore often opting for a cafe lunch instead of packing one from home. However, as home pod/capsule coffee machines have become more popular, the industry has experienced a reduced market share and the age group has declined as a proportion of revenue over the past 5 years.

People aged 55 and above

People aged 55 and above account for the smallest part of the industry at 27.8%, mainly as they are retired or approaching retirement and are happy to socialise around coffee from the comfort of home. This age group is also less likely to buy a coffee during peak period i.e. before work. Over the past 5 years, this age group has increased slightly from 26.7% in 2018.

Financial Overview

In 2018, the data highlighted that industry cafe owners were split, claiming their business was financially better off (35.71%), financially the same (32.14%), and financially worse off (32.14%) compared to the previous year. This appears to display a healthy balance between optimism and pessimism between the operators contacted.

However in 2021, 51.85% of cafe owners claimed their current sales projection were worse off compared to last year, while 29.63% expected their business to be in the same financial position, and only 18.52% claimed their business operations were financially better off.

Throughout the period covered, the sentiment has significantly declined, highlighted by the fact that 52% of operators expect their sales to decrease in the upcoming 12 month period.

IBIS predicts that over the next 10 years, the industry is projected to grow at an annualised rate of 0.1% whereas the overall economy is expected to grow at 1.8%. This indicates that the coffee industry is growing at a much slower rate than the overall economy, and that sales growth is stalling.

In 2018, 37% of operators expected a net profit of 6-10%. In 2021 this has decreased to 29%. A further 33% of operators in 2018 expected a modest profit of 0-5% compared to 41% in 2021.

The negative outlook of owners in 2021 is further evidenced by the doubling of the number of operators expecting their cafe to trade into a loss position in the coming financial period.

The ability to control the two primary costs behind any cafe (being labour and food costs) underpins the success of any cafe. While this appears simple, the results are achieved by having the right menu, fit-out / layout, team, systems and processes. With 50% - 70% of revenues being spent on labour and cost of goods, no other cost deserves as much attention by management. However, having a competitive lease (rent) is another cost that can often be poorly managed, particularly by new and eager entrants.

80% of respondents in 2018 agreed that labour was the most important cost to control within their busines, this compared to 67% of respondents now in 2021.

In 2018, this was followed by 10% of respondents noting rent and purchases equally the next most critical expense. In 2021, a significantly higher 21.4% were concerned about managing their cost of supplies.

Workforce and Wages

Skilled employees - such as baristas, chefs, and waiting staff - are key to achieving sustainable sales. Quality employees can attract more customers and hence generate more income for a business. Despite that, these highly skilled employees can be hard to find and keep. In the current climate, there are many cheaper substitutes, most notably 7-Eleven's poplar $1 coffee. Operators therefore must understand and cater for the reason consumers purchase their daily cup of coffee from their local cafe. Customers want to enjoy that 5 or 15 minute social interaction, flicking through the newspaper, catching up with friends or savouring a few minutes peace in their busy, everyday lives.

Skilled employees - such as baristas, chefs, and waiting staff - are key to achieving sustainable sales. Quality employees can attract more customers and hence generate more income for a business. Despite that, these highly skilled employees can be hard to find and keep. In the current climate, there are many cheaper substitutes, most notably 7-Eleven's poplar $1 coffee. Operators therefore must understand and cater for the reason consumers purchase their daily cup of coffee from their local cafe. Customers want to enjoy that 5 or 15 minute social interaction, flicking through the newspaper, catching up with friends or savouring a few minutes peace in their busy, everyday lives.

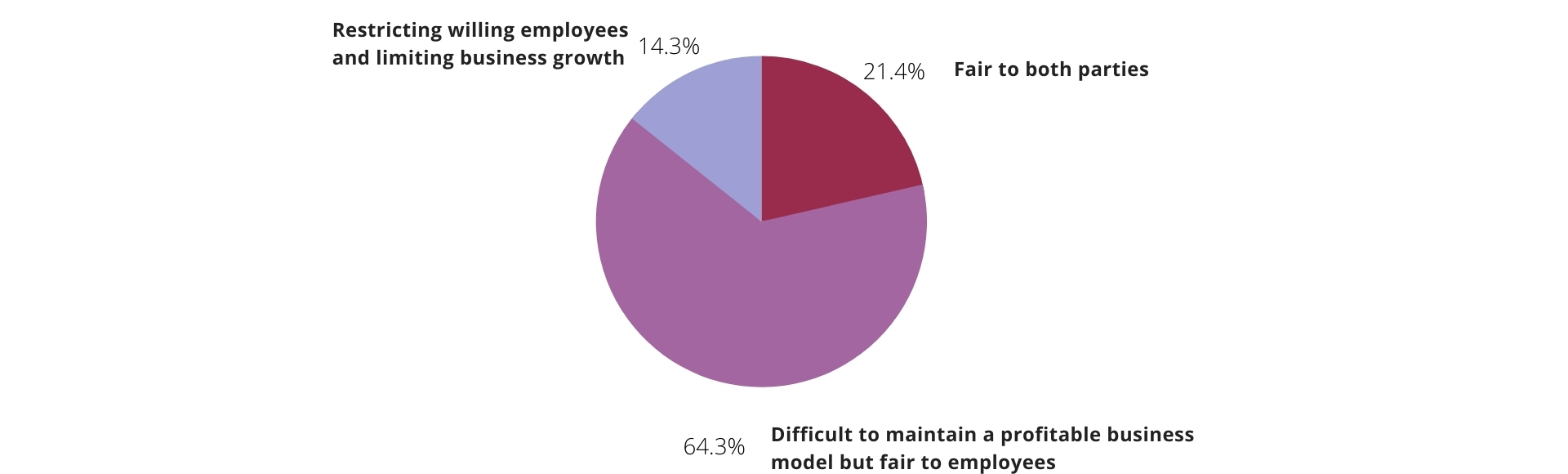

Not surprisingly, respondents found the current minimum award rates fair to employees (70% in 2018 / 64% in 2021) but difficult to work into a profitable business model.

Only 4.35% of owners in 2018 felt the award rates were fair to both parties which actually increased quite a bit to 21.4% in 2021. Furthermore, a majority of respondents in 2021 were expecting to increase the size of their teams. Despite the COVID-19 lockdowns and fears of rising unemployment, the challenge currently seems to find motivated and experienced staff in what is now a highly competitive industry.

2021 - Current Award Rates and Minimum Wages

Marketing Tools and Delivery Services

Preferred Marketing Tools

To give an insight into how cafe retailers promote their business, we constructed a list of 8 key marketing tools that cafe retailers use to promote their business, and asked the respondents to rank them from most important to least. In 2018, the top 3 marketing tools identified were Social Media (Facebook and Instagram), Zomato, and SEO (Google). In 2021, the cafe owners surveyed felt similarly about Social Media, ranking it the most important marketing tool. However, Zomato didn’t rank in the top 3 at all and was replaced by Google Pay-Per-Click (PPC) marketing, again followed by SEO.

Delivery Services

In 2018, the majority of cafes (62%) were not using any services to deliver their products to customers. Whereas in 2021, an additional 14.8% started to deliver services through third-party providers, with Uber Eats (38%) and Deliveroo (15%) being the preferred suppliers.

Following the COVID-19 pandemic, operators were forced to innovate and adapt. This was particularly true in Victoria where multiple lockdowns forced dine-in options to close. In 2021, survey respondents identified that during the pandemic, 44.4% of cafes were forced to adopt a takeaway-only business model and 14.8% utilised their time in lockdown to renovate, remodel and improve their fit-outs.

Surprisingly, only 3.7% of cafe owners temporarily shut down their business operations altogether.

2021 - Cafes responses to COVID 19 Lockdowns and restrictions

Software to Operate The Business Financing

Software to Operate The Business

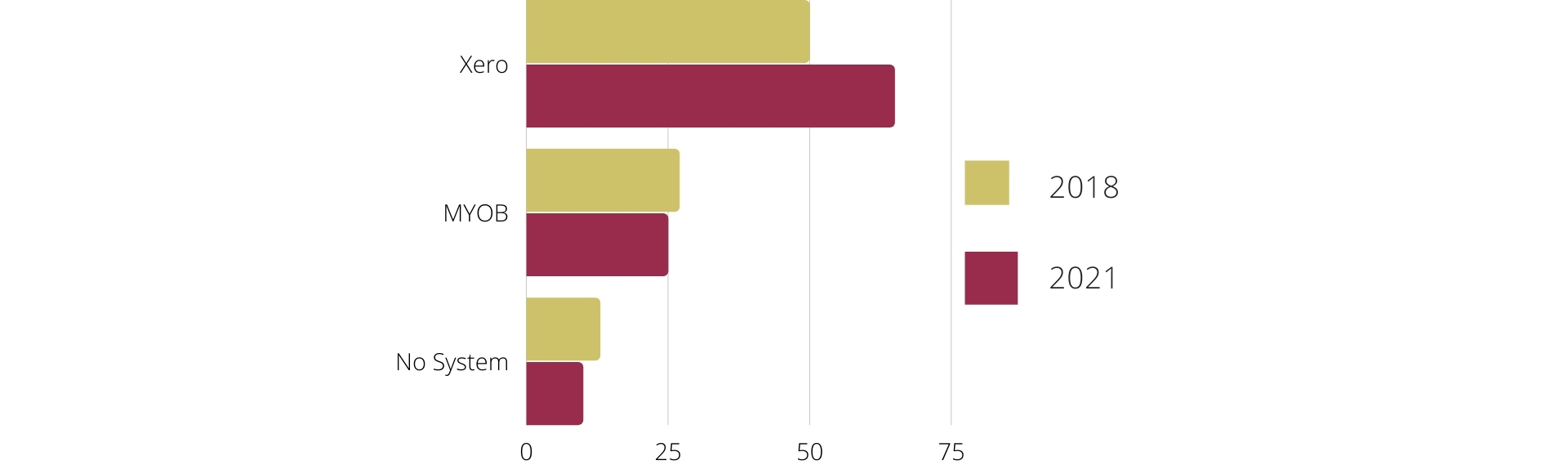

Cafe and coffee shop owners identified the most popular and required IT systems used to operate their businesses.

Our survey respondents were consistent as 2018 and 2021 had similar results highlighting that accounting and bookkeeping software were the key IT systems used in running their business, followed by point of sale (POS) and ordering systems, Payroll and timesheets software.

Financing

Cafe retailers utilised a combination of financing options to start, run, grow and keep their business running. In 2018, 40.9% utilised the Big 4 banks (Westpac, NAB, CBA, and ANZ) to fund their business, followed by Private Investors and Equipment finance (i.e. silver chef) (32%), and the balance of operators being self-funded (27%). In 2021, 39% remained with the Big 4 banks, however, the biggest change was that self-funded businesses grew to 39% and both Private Investors and Equipment finance (i.e. silver chef) fell to just 8%.

COVID-19 has had serious implications upon the financial stability of cafes and coffee shop owners, particularly in New South Wales and Victoria which had multiple state lockdowns compared to South Australia and Western Australia. Surprisingly, 77% of survey participants had not taken out a business loan to recover from the pandemic to assist them in the re-launch of their full services and hours. 14.81% of cafe owners had thought about taking out a loan and 7% had taken out a loan to assist them moving forward through the pandemic.

COVID19 Pandemic

When contacting respondents in 2021, additional questions were introduced to focus on the impact of COVID-19.

We asked all cafe owner participants on a scale of 1 to 10 (10 being most difficult) how hard was the effect of COVID-19 upon your business operations? The average response from cafe owners was 7.6, and 37% of cafe owners rated the experience a 10 out of 10.

The JobKeeper Payment Scheme was a federal government scheme which ended in March 2021. It was designed to help struggling businesses (sales decrease > 30%) that were affected by the pandemic to cover the costs of their eligible employees until operations could re-commence at full capacity. We asked participating industry owners if they had enrolled in the government-assisted JobKeeper program and 93% of businesses said that they had. 44% of cafe owners that were enrolled in the program rated it a 10 (out of 10), with 10 being the most helpful in keeping their business operating throughout the pandemic. Although The JobKeeper Program was a $101 billion dollar economic lifeline to Australian businesses, it was not the only federal or state payment scheme or grant available. Participants acknowledged other government support programs that they were eligible for including:

- Victorian capital works grants

- Victorian State Government support $5000 grant

- Victorian State government grants for BAS relief

- Victorian stimulus package

- NSW state government grants

- Tasmania state government grants

- Small local Tasmania state grants

- South Australian state government grants

When deciding to leave the safety of a PAYG position to acquire or start a small business, owners would generally focus on the financial benefits and risks involved in the venture.

However in 2021, the pressures and stresses faced by owners was evident when we asked participants about the impact on their mental health. We asked them on a scale of 1 to 10 (with 10 being a significantly negative impact on their emotional well-being), how did COVID-19 impact your mental health? The average number was 6.7 and 37% of participants recorded a score of 10 for significant negative impact.

Summary

Advice for new entrants

For those interested in opening a cafe business, our respondents were asked what key advice they would give to new entrants. Their answers are as followed:

Other specific advice that respondents provided included:

- Minimise rent without compromising foot traffic

- Don’t borrow more money than you can afford to repay. Work out what you need to take in revenue to break even each week/month

- Get a good rent, get advice before starting, price your menu accordingly

- The fit-out and atmosphere of space really does matter

References

www.accc.gov.au

www.asx.com.au

www.accc.gov.au

www.rba.gov.au

www.ato.gov.au

www.ibisworld.com

www.chefworks.com.au

www.statista.com

www.squareup.com

www.communicafe.com

www.worldatlas.com