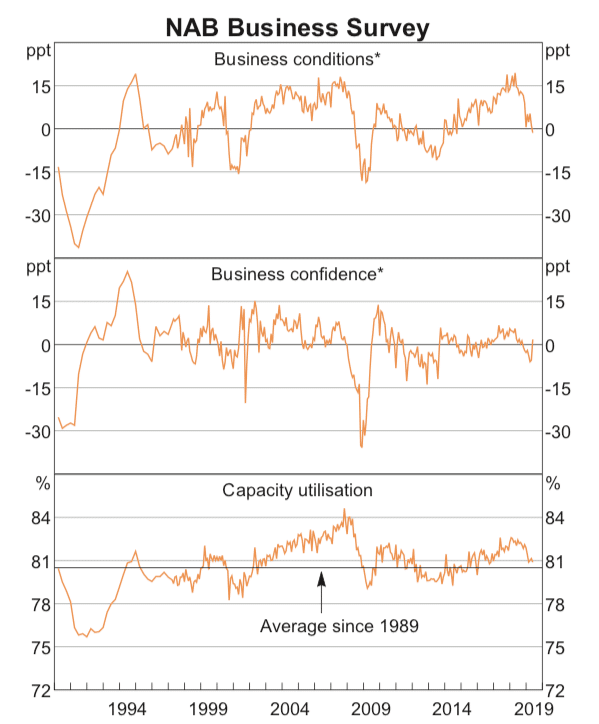

Unfortunately, after a number of strong quarters, the recent period highlighted a number of concerning trends impacting on small business confidence. Many economists had expected the economy to pick up following the recent Federal Elections, however, there have been few signs of improvement.

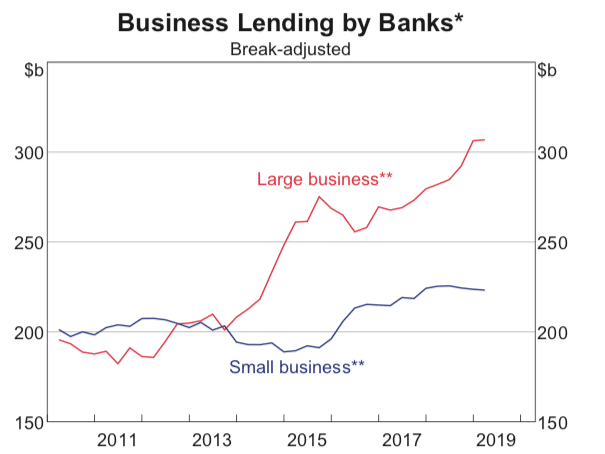

A major constraint on small business that we have noticed first hand is the limited access to bank financing. Responsible lending crackdowns initiated by APRA has resulted in a credit slowdown. Where cashflow forecasts and historical performance would support loan applications in prior years, the major banks are now taking an ultra-conservative approach even when private director assets are used as security against a loan priced for business lending.

We expect the lack of credit to be a short to medium term obstacle for small business. Innovation is continuing in the industry through the entry of a number of second and third tier lending providers.

These providers are using technology to speed up the application process by gaining direct access to clients accounting records. While many of these lenders are offering significantly higher rates, the continued increase of new players in this market will ensure the interest rate gap between the parties to be reduced which will further prompt the major banks to increase their risk appetite.

The continuing increase in the cost of employing staff is a major challenge for SMEs. Minimum wages increased 3% in the period, significantly higher than the increase in CPI. Compounded with an increase in penalty rates and the continued increase in Superannuation Guarantee rates that will rise to 12% by 2025 employers are reluctant to take on new staff. The reported 5.2% unemployment rate does not accurately reflect the underutilization of workers.

Our Crystal Ball Predictions for 2020

- RBA Office Cash Rate to fall to 0.5%

- Housing to drop a further 5% – 10%

- All Ordinaries to fall back to 6,500 points

- Unemployment to increase to 5%

- CPI (Inflation) to fall to 1%

- Building and Construction industry to face falling revenues of over 10% + with many major players forced into liquidation

- Exponential growth in the Gig economy

- Increase in acceptance and take up of business equity crowd funding

Best Performing Industries 2019

- Ecommerce / Online Retail

The pain experienced by traditional brick and mortar retailers has only been softened by those who have embraced and invested in online. While traditional retail sales growth has remained flat despite heavy discounting, online sales growth has by over 19%.

- Car Sharing

Car sharing providers have enjoyed an increase of over 20% in year on year revenue growth. The increase has been the result of an increase in urbanization and advances in internet technology.

- Smartphone APP Developers in Australia

The APP development market is now generating over $2 billion dollars of revenue annually (double the revenue generated in 2013). The industry increased by 15% in the current period and is forecast to continue growing at 7% until 2024.

- Serviced offices and Co – working spaces

Technology and current labour markets have increased the number of entrepreneurs, freelancers and those entering the Gig economy. The serviced offices market increased 12% in 2019.

- Baby Food Manufacturing

Demand for premium and organic baby food both domestically and through often illegal international exporting to countries such as China has ensured the baby food manufacturing industry continues to grow, albeit at more modest rates than in previous years.

- Organic Fruit and Vegetable Farming

Australians have voted with their wallets that they are happy to pay a significant premium for organic certified goods. Organic fruit and vegetables sales have continued to grow at double digit rates for the past 6 years, with growth of 15% recorded in 2019.

- Online, Online, Online

Consumer trends are following countries like America who seem to be about 5 years in front of Australia with their adoption of online shopping. Industries including online travel, auto, flowers, furniture, video games, clothing, toys, perfumes, alcohol and pet food have all enjoyed healthy growth rates of 5% to 20%.

- Solar Electricity Generation

Solar energy industry has been increasing at triple digit rates for the last 5 years and is now expected to grow at more modest rates (17%) going forward. With high electricity prices, government incentives available and a strong consumer focus on moving to environmentally friendly practices the industry will continue to flourish.

Other notable mentions for solid industry growth include:

- Seafood processing

- Mining

- Metal roof and guttering manufacturing

- Shipbuilding

- Internet publishing and broadcasting

- Software publishing

- Intellectual property leasing

Source: Rates and statistics taken from www.ibisworld.com

Worst Performing Industries 2019

- Printing and Magazine Publishing

Traditional print-based services have fallen another 6% as the move to internet- based services continue to erode demand. With the demise of many players in the industry the print supply levels are getting close to a base demand level. Those who have survived may now enjoy better times ahead.

- Video and DVD Hire Outlets

Another declining industry that will continue to fade out to extinction. With pay per view and internet based streaming services there is no future in DVDs as this technology becomes obsolete.

- Cotton Growing and Farming

The cotton growing industry has been hit hard through a number of external factors, namely the volatile climate ranging between floods to droughts. As a result, many farmers have dedicated less and less farming space to cotton and as such the produce yields have fallen sharply.

- Book Stores

Personally, the appeal of a book outweighs the convenience of reading a book on smart devices such as a Kindle or iPhone. However, the writing is on the wall with the majority voting for convenience over the atheistic pleasure of reading a hard cover book. It has been 12 years since the book store industry in Australia last recorded a positive increase in sales. Total sales fell a further 4.3% in 2019.

Other notable mentions for industries facing challenging conditions:

- Leather and leather goods manufacturing

- Agricultural machine manufacturing in Australia

- Household appliance manufacturing in Australia

- Clay brick manufacturing

Source: Rates and statistics taken from www.ibisworld.com

Reasons to be optimistic:

- RBA monetary easing (rate cuts) to continue

- Government tax returns to stimulate short term consumer spending

- APRA relaxation of borrowing requirements likely to increase consumer borrowing power by 15% – 20%

Reasons to be pessimistic:

- Housing market likely to fall further

- Retail spend unlikely to improve in the short to medium term

- Continued growth in technology and online based businesses

- Population growth masking the underlying health of the local economy

Expected opportunities

Following the greatest investor of all times advice the Oracle of Omaha AKA Warren Buffet encourages investors to “be fearful when others are greedy and greedy when others are fearful.” Possible opportunities that may arise include:

- Lease expenses

Commercial vacancy rates are mixed, however many previously in demand retail shopping strips are suffering all time high vacancy rates.

For example, we have helped clients move into locations including Chapel Street (Prahan Victoria). Often the lease terms offered include net rent up to 60% lower than the previous tenant and numerous lease incentives.

Taking the contrary view, there is significant investment going into Chapel St to bring back its reputation as a major shopping attraction. This could be an opportunity for a new business just as it is a threat for existing business.

- Acquisitions

Business conditions are cyclical and at the bottom of a cycle the valuations used to value a business for sale can be significantly lower. Buying a business in distress in such times can result in opportunities for potential buyers.

- Survival of the fittest

Challenging business conditions will thin out existing competitors to more sustainable levels. Further such conditions will force internal reviews creating a leaner business model with a defined strategy going forward.

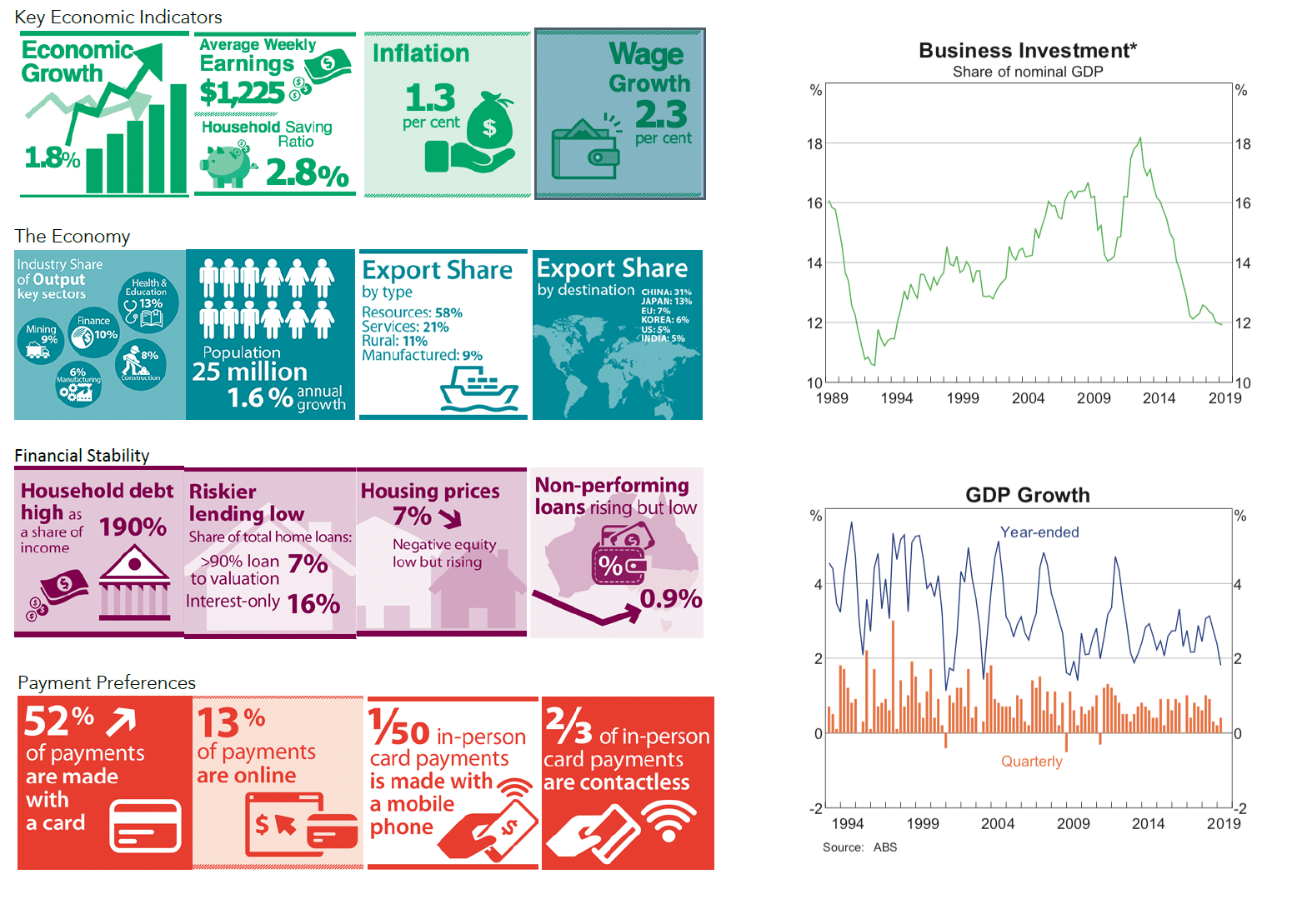

Industry and Economy Trends (www.rba.gov.au)